Market conditions in and around the Charlottetown cottage market are currently balanced with no markers to indicate a change in this state for the rest of the year; prices have remained affordable and the amount of inventory in relation to demand is balanced.

Over the last year, most buyers were split between local and out-of-province, with young and middle-aged couples, particularly Gen Z, leading the charge in cottage sales for the year.

Average recreational property sale price increased by 9.2 per cent year-over-year (from $268,000 in Q1 2022 to $292,550 in Q1 2023). While the average number of transactions decreased by 29 per cent year-over-year (from 24 in Q1 2022 to 17 in Q1 2023). Although the number of sales is down, it’s predicted that more people will begin purchasing property to build a year-round recreational home in Charlottetown. Furthermore, sales are anticipated to increase by three-five per cent over the remainder of 2023.

With approximately 900,000 Baby Boomers expected to retire within the next three years, the Charlottetown area is anticipating a shift in the way these consumers engage with the market – and their recreational homes. This mass exodus of Baby Boomers from the workforce will likely affect the Charlottetown area’s condo market more than recreational homes, as Baby Boomers often seek property options that enable them to head south for the winter. Likewise, it’s anticipated that Baby Boomers with “true” cottages (i.e., homes that are not used year-round and only visited a few times a year) will likely sell them to build on the land or buy year-round homes in the same areas. For those deciding to transfer their properties to a family member, however, it becomes more complicated.

“Taxes are going to be the biggest challenge in older generations shifting their cottage properties to younger family members. Of course, there are always perks to owning a second home, but consumers should also be weary of the drawbacks – especially from a tax perspective. Taking over a cottage property from a family member is a big decision to make, but there are creative solutions families can undertake to make it worthwhile long-term.” says Mary Jane Webster, Broker Owner, RE/MAX Charlottetown Realty.

Charlottetown real estate is experiencing sellers’ market conditions, driven by out-of-province buyers who have been influenced by the notion that Prince Edward Island has been positioned as one of the safer places to be in Canada, based on the number of COVID-19 cases and hospitalizations. This has put pressure on the region’s housing inventory, which was already stretched this before the pandemic, and has struggled to meet demand.

Due to the small size of the province, many recreational homes here can be used year-round. As a result, there exists a mix of true “cottages” that have been purchased by local buyers opting for an affordable second property, as well as those that have full four-season capacity on the higher end. Preferred features for recreational homes include proximity to water, Wi-Fi access and ample space/square footage.

Due to the small size of the province, many recreational homes here can be used year-round. As a result, there exists a mix of true “cottages” that have been purchased by local buyers opting for an affordable second property, as well as those that have full four-season capacity on the higher end. Preferred features for recreational homes include proximity to water, Wi-Fi access and ample space/square footage.

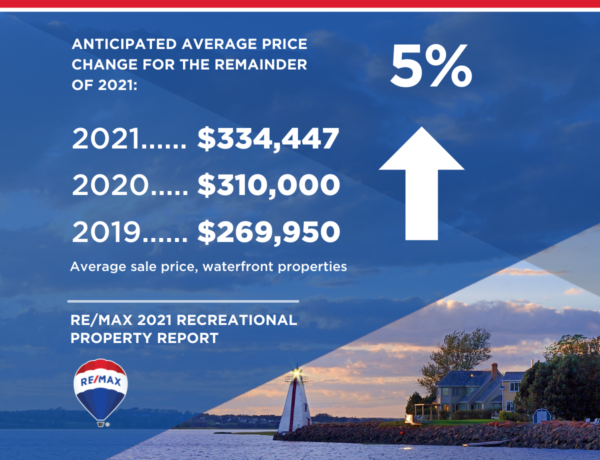

Anticipated price growth for recreational properties in the Charlottetown real estate market for the remainder of 2021 is an increase of +5% for waterfront properties, and +7% for non-waterfront properties.

Canada-Wide Cabin & Cottage Trends

The red-hot demand seen across the Charlottetown real estate market is a common thread across Canada, as interest and activity in suburban and rural property markets continues to grow. Despite rising demand, 57 per cent of Canadian recreational markets still have at least one property type with average prices below $500,000, according to the 2021 RE/MAX Recreational Property Report.

This bodes well for the 78 per cent of Canadians who plan to purchase a property in the next year and consider themselves to be “recreational buyers,” according to a Leger survey that was conducted on behalf of RE/MAX.

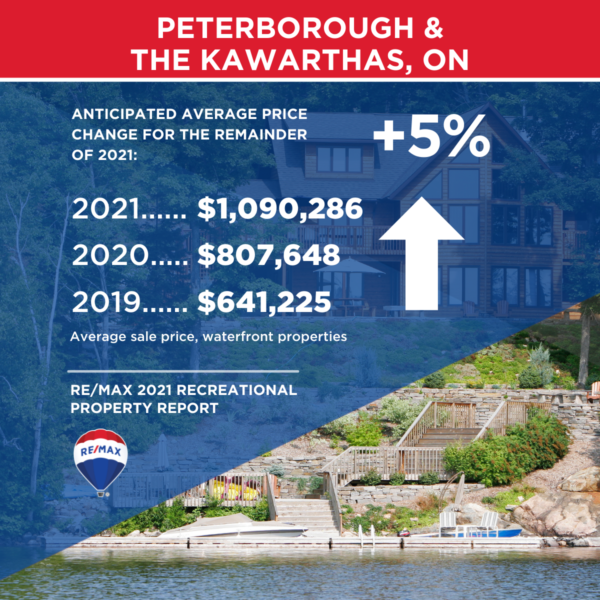

Ontario-Atlantic Canada (Average price)

.

.

Western Canada (Average price)

.

.

More than half of those who plan to purchase a property in the next year (59 per cent) are first-time recreational property buyers. Of those planning to purchase a recreational property, 21 per cent are looking to recreational markets after being priced out of an urban centre. However, low borrowing rates are working in their favour, with 22 per cent saying the lower rates have increased their ability to buy.

The survey also found that 11 per cent of Canadians were searching for a recreational property prior to the start of the pandemic and are still searching, and 15 per cent of Canadians who were not searching for a recreational property prior to the pandemic are now looking.

Shifting home-buying trends, as prompted by the pandemic, are exacerbating inventory challenges in a majority of recreational markets across Canada. The growing demand in these regions is also putting upward pressure on prices which is impacting affordability in many recreational markets, which RE/MAX brokers anticipate will be a long-term trend.

“There’s intense competition among buyers in Canada’s recreational property markets and inventory is stretched thin,” says Christopher Alexander, Chief Strategy Officer and Executive Vice President, RE/MAX of Ontario-Atlantic Canada. “But Canadians recognize that recreational properties remain an affordable option in such a turbulent market. There are still many recreational markets across Canada that are deemed affordable, despite the growing demand and rising prices.”

Affordability Outlook

According to RE/MAX brokers and agents, sellers’ market-like conditions are anticipated to persist for the remainder of the year in 97 per cent of regions examined in the report. These conditions are typically accompanied by rising prices, which has been a trend in 2020 that is expected to continue through 2021. RE/MAX brokers report that 57 per cent of Canada’s recreational markets include at least one property type priced in the $200,000 – <$500,000 range. This is down from 87 per cent in 2019.

The most affordable recreational regions for waterfront properties across Canada include Thunder Bay ($425,805), Charlottetown ($334,447) and Interlake Region of Manitoba ($363,833), while Okanagan ($2,430,434), Barrie-Innisfil ($1,841,217) and Niagara region ($1,546,561) are the most expensive recreational property markets for waterfront properties.

“In today’s real estate landscape, with increased demand and ongoing supply issues putting pressure on prices and sparking bidding wars, industry professionalism is of utmost importance,” says Elton Ash, Regional Executive Vice President, RE/MAX of Western Canada. “Recreational markets across Canada are feeling the pressure, and without a solution to address supply issues, we are running out of affordable options for Canadians.”

Unsurprisingly, affordability remains the top buying criteria for 41 per cent of Canadians who are in the market for a recreational property, followed by proximity to water or waterfront, amenities and good Wi-Fi. With demand for recreational properties anticipated to remain strong for the remainder of the year, lifestyle factors typically found in city homes, such as restaurants, Internet connection and office space are expected to remain a priority among buyers.

The post Charlottetown Cottage Market Trends (2023) appeared first on RE/MAX Canada.