Seller’s market to persist in Kelowna housing market in 2022, prices expected to rise 9%

Seller’s market conditions are expected to persist in the Kelowna housing market in 2022, conditions prompted by tight housing supply. Low interest rates could also play a role for buyers in 2022, specifically there’s a possibility that the market may see a flurry of buyers rushing to purchase in the new year to take advantage of the lower rates, before the Bank of Canada’s anticipated rate increases begin to take effect starting in the spring. This may result further upward pressure on prices, as supply remains limited.

Buyers relocating to central Okanagan are likely to continue pushing demand and prices up into 2022. Three of the most desirable neighbourhoods in Kelowna are Lower Mission, South Pandosy and Wilden. As the Canadian economy continues to strengthen, housing is expected to continue to do the same, with more retirees looking to Kelowna for its quality of life and relative affordability.

Single-detached homes in the region have experienced the greatest year-over-year price appreciation from $858,741 in 2020 to $1,050,667 in 2021 (+22.3%); followed by townhomes from $545,227 in 2020 to $648,127 in 2021 (+18.8%); and condominium apartments from $367,362 in 2020 to $439,823 in 2021 (+18.3%).

Specific housing amenities are expected to be prioritized by buyers in 2022, including: pools; family space; home offices; and yards.

When it comes to new construction, new single-family homes are being hampered by the lack of building lots. For first-time homebuyers the typical range to enter the Kelowna market is $600,000 – $800,000 which is anticipated to continue into 2022.

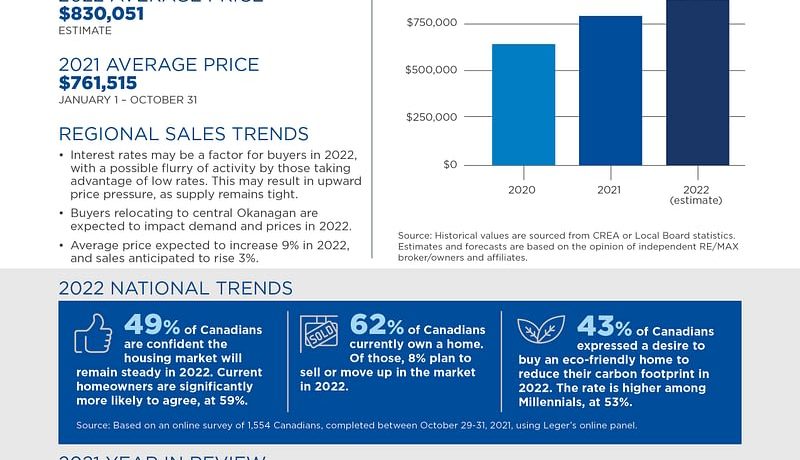

Average residential sale prices in the Kelowna housing market are anticipated to increase by nine per cent in 2022.

Canadian Housing Market Outlook for 2022

From a national perspective, RE/MAX is anticipating steady price growth across the Canadian real estate market in 2022, with inter-provincial migration continuing to be a key driver of housing activity in many regions, based on surveys of RE/MAX brokers and agents, as reflected in the 2022 Canadian Housing Market Outlook Report. The ongoing housing supply shortage is likely to continue, putting upward pressure on prices. As a result of these factors, RE/MAX Canada estimates a 9.2-per-cent increase in average residential sales prices across the country*.

.

“Based on feedback from our brokers and agents, the inter-provincial relocation trend that we began to see in the summer of 2020 still remains very strong and is expected to continue into 2022,” says Christopher Alexander, President, RE/MAX Canada. “Less-dense cities and neighbourhoods offer buyers the prospect of greater affordability, along with liveability factors such as more space. In order for these regions to retain these appealing qualities and their relative market balance, housing supply needs to be added. Without more homes and in the face of rising demand, there’s potential for conditions in these regions to shift further.”

Despite the global pandemic, many Canadians still feel confident in the real estate market. According to a Leger survey conducted on behalf of RE/MAX Canada, 49 per cent of respondents believe Canadian real estate will remain one of their best investment options in 2022 (59 per cent of homeowners vs. 34 per cent non-homeowners which included renters, those not looking buy, and those currently looking to purchase). Additionally, 49 per cent of respondents are confident the Canadian real estate market will remain steady next year.

“Canadians recognize the value and investment potential in their homes. However, market challenges such as rising prices and limited supply have impacted local markets from coast-to-coast, causing angst this past year among those looking to get into the market and those hoping to move up in it,” says Elton Ash, Executive Vice President, RE/MAX Canada. “Despite this, it’s encouraging to see that many are feeling confident in the housing market in 2022 and view Canadian real estate as a solid investment.”

Additional findings from the 2022 Canadian Housing Market Outlook Report

- Two-in-five Canadians trust their agent to advise them during the current real estate landscape (43 per cent)

- 23 per cent of Canadians now have a greater desire to build their own home or buy pre-construction

- 26 per cent of Canadians have the desire to purchase a home while mortgage rates remain low

- 62 per cent of Canadians currently own a home. This is higher among those ages 35+ (70 per cent) compared with Millennials, ages 18-34 (42 per cent)

- The majority of Canadians (72 per cent) said rising home prices did not impact their purchasing decisions in 2021.

ARCHIVE

The Kelowna housing market saw a substantial loss in sales activity during the peak of COVID-19. As economies gradually begin to reopen, the market has seen an equally substantial increase in activity as buyers and sellers alike try to make up for lost time.

Both the average saes price and the number of sales this July have matched or surpassed those of 2019. The region is experiencing greater interest in single-family homes and land, as the recent condo insurance premiums appear to have dampened interest in the condo market. As travel restrictions continue to be in place, a large majority of sales are expected to continue to be from the local Kelowna Board region and greater British Columbia.

During these unprecedented times, the COVID-19 pandemic has made it though to predict how the 2020 Kelowna housing market will finish. If the last couple of months are any indication of where we are heading, 2020 should end with a strong upward trend.

Western Canada

While COVID-19 lockdowns in March and April slowed down the housing market in Western Canada, transactions in Kelowna, Saskatoon and Vancouver resumed by May, with sales in both May and June surpassing year-over-year levels. Many buyers put their plans on hold at the peak of COVID-19 lockdowns, but they returned to the market quickly to make up for lost time. Edmonton’s housing market quickly bounced back to pre-COVID levels in June, while Saskatoon experienced its busiest June in years; this momentum is anticipated to continue into the fall market, with RE/MAX brokers and agents estimating a three-per-cent increase in average residential sale prices for the remainder of the year. Overall, brokers and agents in Western Canada say the potential buyers they are talking to are not too concerned with a potential second wave of COVID-19 impacting their real estate journey, and RE/MAX brokers are estimating steady activity to round out 2020.

.

Canadian Housing Market Outlook

Leading indicators from RE/MAX brokers and agents across Canada’s housing market point to a strong market for the remainder of 2020. According to the RE/MAX Fall Market Outlook Report, RE/MAX brokers suggest that the average residential sale price in Canada could increase by 4.6% during the remainder of the year. This is compared to the 3.7% increase that was predicted in late 2019.

.

The pandemic has prompted many Canadians to reassess their living situations. According to a survey conducted by Leger on behalf of RE/MAX Canada, 32% of Canadians no longer want to live in large urban centres, and instead would opt for rural or suburban communities. This trend is stronger among Canadians under the age of 55 than those in the 55+ age group.

Not only are Canadians more motivated to leave cities, but changes in work and life dynamics have also shifted their needs and wants for their homes. According to the survey, 44% of Canadians would like a home with more space for personal amenities, such as a pool, balcony or a large yard.

Canadians equally split on their confidence in the housing market

Canadians are almost equally split in their confidence in Canada’s real estate market, with 39% as confident as they were prior to the pandemic, and 37% slightly less confident. When it comes to the prospect of a second wave of COVID-19, 56% of Canadians who are feeling confident in Canada’s real estate market are still likely to buy or sell.

“While COVID-19 lockdowns slowed Canada’s housing market at the start of a typically busy spring market, activity bounced back by early summer in many regions, including Vancouver and Toronto,” says Elton Ash, Regional Executive Vice President, RE/MAX of Western Canada. “Despite the tragic impacts of the pandemic, our optimism in the strength of Canada’s housing market has always remained, and current market activity further exemplifies this. Many homebuyers are now exploring different neighbourhoods that better suit their new lifestyles, and real estate agents are getting busier and working more with buyers from different major cities. According to our brokers and agents across the RE/MAX network, Canada’s fall market is expected to see spring market-like activity.”

Additional highlights from the 2020 RE/MAX Fall Market Outlook Report Survey:

- 48% of Canadians would like to live closer to green spaces

- 48% of Canadians say it’s more important than ever to live in a community close to hospitals and clinics

- 33% of Canadians would like more square footage in their home and have realized they need more space

- 44% of Canadians want a home with more outdoor space and personal amenities (i.e. balcony, pool etc.)

About the 2020 RE/MAX Fall Market Outlook Report

The 2020 RE/MAX Fall Market Outlook Report includes data and insights supplied by RE/MAX brokerages. RE/MAX brokers and agents are surveyed on market activity and local developments.

The Kelowna housing market is expected to be a balanced market in 2020, with a zero percent residential sale price expectation. After seeing an approximately eight percent decrease year over year in number of sales, the market is expected to adjust and will remain steady into 2020.

There is currently 6.87 months of inventory and these levels are expected to remain similar in 2020. Taxation, weather patterns and Alberta and lower mainland’s economy will have the greatest impact on the Kelowna market in 2020. The projected population growth for B.C. (approximately 50,000 new residents between now and 2040) will also have a large impact on the housing market in the region as we look ahead to the next 3-5 years.

Condos, one-story detached and two-story detached are the most popular properties in Kelowna with Lower Mission and Westbank Centre being two popular neighborhoods for sales. Kelowna North is expected to be the hottest neighbourhood in 2020 due to its proximity to the downtown core, lake and current development growth.

Move-over and first-time home buyers are expected to drive demand in 2020 while luxury home sales in the region have tapered off year over year as a result of the new speculation tax impacting those with another primary residence.

From a national perspective, RE/MAX anticipates a leveling out of the highs and lows that characterized the Canadian housing market in 2019, particularly in Vancouver and Toronto, as we move into 2020. Healthy price increases are expected, with an estimated 3.7-per-cent increase in the average national residential sales price.

From a national perspective, RE/MAX anticipates a leveling out of the highs and lows that characterized the Canadian housing market in 2019, particularly in Vancouver and Toronto, as we move into 2020. Healthy price increases are expected, with an estimated 3.7-per-cent increase in the average national residential sales price.

“The drop in sales in key markets across British Columbia can be partially attributed to Canadians’ increasing difficulty in getting an affordable mortgage in the region,” says Elton Ash, Regional Executive Vice President, RE/MAX of Western Canada. “The situation created by the introduction of the mortgage stress test this year, as well as continually increasing interest rates, means more Canadians will be priced out of the market.

Click to read the full RE/MAX 2020 Housing Market Outlook Report.

Learn more about RE/MAX real estate franchise opportunities in Ontario-Atlantic Regio

Kelowna housing market to remain a sellers market in 2021, prices expected to rise 5%

Kelowna real estate is likely to continue as a seller’s market in 2021, with an active year ahead. This is characterized by a growing demand for single family and townhomes away from big cities. The COVID-19 pandemic and potential fallout in the United States will continue to drive these conditions into 2021. The average sales price in Kelowna increased 5.6% to $553,175 in 2020 (Jan. 1 – Oct. 31), compared to $523,832 in 2019 (Jan. 1 – Dec. 31). The RE/MAX Outlook for Kelowna real estate in 2021 is an increase of approximately 5% in average price to approximately $580,833 across all property types.

Who’s Driving Demand for Kelowna Real Estate?

Move-over buyers are currently driving demand in the Kelowna real estate market, which is expected to continue in 2021. While this has not specifically changed since the beginning of 2020, it emphasizes the increase in people selling their home in a less desirable area (perhaps pandemic influenced), to move to a more desirable location.

First-time homebuyers in Kelowna are typically families seeking single condominiums and townhomes ranging from about $350,000 to $550,000. First-time homebuyers who had a difficult time buying real estate in 2020 are unlikely to find any relief in 2021, with low inventory and rising prices in Kelowna expected to continue into the next year.

There has been some hesitation seen in first-time homebuyers in 2020, as real estate prices never dropped. As inventory in Kelowna continues to stay low, prices will hold as we move into 2021.

Move-up buyers in the Kelowna area are typically young couples. There has been very little hesitation in move-up buyers, as the COVID-19 pandemic has driven more young couples to sell their condos and townhomes in the Lower Mainland and buy single-family homes in the suburbs in Kelowna. This is expected to continue into 2021. Limited supply and rising prices have proven to be difficulties that move-up buyers have to face when purchasing in Kelowna.

The condominium market in Kelowna was the only category that showed a decrease in sales year over year in 2020. However, the average sale price for condos has remained steady, which is expected to remain the same in 2021. The Kelowna condominium market is popular with single homebuyers, and a falling demand in condos is expected in 2021.

Kelowna’s luxury market is currently driven by move-up buyers, with the typical starting price for a luxury home in Kelowna being approximately $1,200,000. COVID-19 initially hurt the luxury real estate market, but Kelowna saw a spike in luxury sales between wave 1 and wave 2 of the pandemic. If the pandemic gets worse, it is expected that luxury sales spike in Kelowna will decrease into 2021.

Kelowna’s Hottest Neighbourhoods

Kelowna’s top-selling neighbourhoods in 2020 were Lake Country, Upper & Lower Mission and Rutland. Lake Country continues to drive new builds at similar prices to older established homes in Kelowna, making it desirable. Rutland continues to have an investor eye for rental potentials and development. Upper & Lower Mission continues to be sought after for desirable neighbourhoods. A noticeable increase in developers seeking land assemblies has been seen in many of the OCP City Centres.

Kelowna New-Home Construction

Kelowna’s new-home construction market was strong in 2020, following a slow down in 2019. Since the beginning of the COVID-19 pandemic, new-home construction activity has steadily increased, and is not currently keeping up with demand. New-home prices are similar to those seen in the resale market in Kelowna, with older homes focusing more on the lot and location within the city, whereas new-construction is focused on the build itself. One new trend that has emerged since the beginning of the COVID-19 pandemic is that more land assemblies in the OCP designated urban centers for condensed mixed-use buildings, which is expected to continue into 2021.

Lake Country is one area in particular that has been doing extremely well in terms of new-home construction, and the area around the University of British Columbia – Okanagan is also steadily growing.

Canadian Housing Market in 2021

Canadians are on the move. RE/MAX isn’t calling this an “exodus,” but the re-location trend across the Canadian housing market is real, and it’s just one focus of the RE/MAX 2021 Housing Market Outlook Report. RE/MAX Canada anticipates healthy housing price growth at the national level, with move-up and move-over buyers continuing to drive activity in many regions across the Canadian housing market. An ongoing and widespread housing supply shortage is likely to continue, presenting challenges for homebuyers and putting upward pressure on prices.

Due to these factors, the 2021 RE/MAX 2021 outlook for average residential prices is an estimate of +4% to +6% nation-wide. Here’s the regional break-down:

Learn more about RE/MAX real estate franchise opportunities in Ontario-Atlantic Region and Western Canada.

The post Kelowna Housing Market Outlook (2022) appeared first on RE/MAX Canada.