The Vancouver real estate market was hot before the coronavirus pandemic shut down the global economy, and it has undoubtedly continued to sizzle since. Is there anything that can slow down the Vancouver housing market?

Vancouver is going through an ebullient and frustrating period for homebuyers and sellers. Ebullient for sellers and frustrating for buyers, that is. From detached properties to condominium units, housing supply is down, resulting in rising prices. But some prospective homebuyers are keeping an eye on interest rates to determine if a rate increase may trigger a decline in sales and in turn, prices.

Considering limited housing stock and elevated demand, the impact of a rising-rate environment could be minimal. That being said, although the housing boom eased in December, conditions were strong throughout 2021. What do the numbers show, and could 2022 be the year of a more modest market?

Vancouver Real Estate Sales Continue to Soar Amid Shrinking Supply

According to the Real Estate Board of Greater Vancouver (REBGV), residential sales tumbled 13.1 per cent year-over-year in December, totalling 2,68 units. However, on a historical basis, home sales were 33.4 per cent above the 10-year average for the month of December.

When assessing the Vancouver real estate market over the course of last year, residential sales surged 42.2 per cent, totalling 43,999 units—an all-time high in the Vancouver real estate market.

Home prices were higher in December across all property types. The MLS® HPI composite benchmark price for detached homes advanced 22 per cent year-over-year to $1,910,200. The benchmark price for attached homes soared 22 per cent to $1,004,900, while apartments jumped 12.8 per cent to $761,800.

Home prices followed the sizzling sales activity in one of Canada’s largest cities. The MLS® HPI composite benchmark price for all residential properties in Vancouver climbed at an annualized rate of 17.3 per cent to $1,230,200.

While housing supply has improved, it has failed to keep up with record-high demand throughout the year. This, says Keith Stewart REBGV Economist, has “caused residential home prices to rise over the past 12 months.”

Last year, home listings swelled nearly 15 per cent to 62,265 units, which was 11 per cent above the 10-year average. Active residential listings fell 38.7 per cent, to 5,236 units.

New housing construction was active in 2021, although some experts contend that it might not be enough. According to Canada Mortgage and Housing Corporation (CMHC), housing starts declined 43 per cent, totalling 1,568 units in November. However, in the first 11 months of last year, housing starts increased close to 18 per cent to 23,828 units.

“Home has been a focus for residents throughout the pandemic. With low interest rates, increased household savings, more flexible work arrangements, and higher home prices than ever before, Metro Vancouverites, in record numbers, are assessing their housing needs and options,” Stewart said in a news release.

“We begin 2022 with just over 5,000 homes for sale across the region. This is the lowest level we’ve seen in more than 30 years,” Stewart added. “With demand at record levels, residents shouldn’t expect home price growth to relent until there’s a more adequate supply of housing available to purchase.”

Is There Any Respite in Sight for the Vancouver Housing Market?

The Bank of Canada (BoC) has signalled that it may raise interest rates as early as March to help curb inflation. This would increase borrowing costs, which have held steady since a trio of drops in March 2020. A higher borrowing rate would increase costs for buyers.

While the consensus is that while higher borrowing rates could potentially lead to some easing in the Vancouver real estate market, industry experts concur that there will not be a sharp correction, particularly as demand remains robust and inventories stagnate at their lowest levels in about 30 years.

Like Toronto, Vancouver is frequently named one of the most desirable places to live, both in Canada and on a global scale. It maintains a thriving economy, gorgeous scenery (mountains and ocean views), and is in close proximity to the United States. With this widely shared opinion, it is hard to imagine this western metropolis suffering a sharp downturn anytime soon.

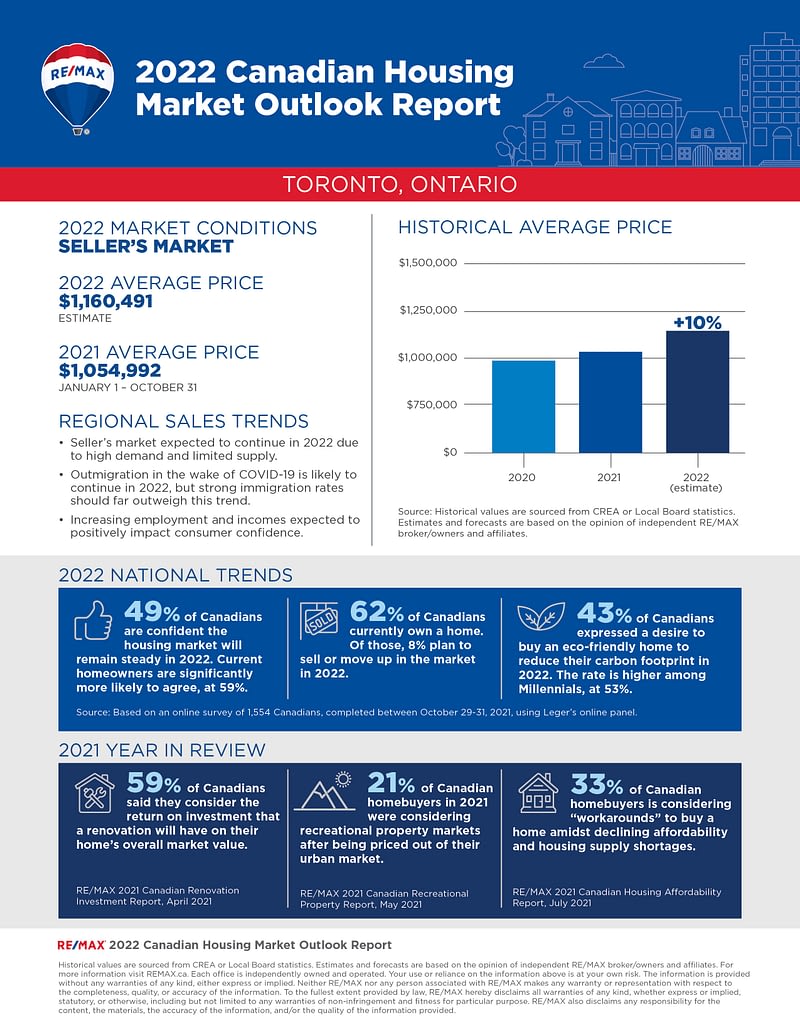

So, looking to the rest of 2022, what can the average homebuyer expect to pay for a property in Vancouver? According to the 2022 Canadian Housing Market Outlook Report, Vancouver real estate prices are forecast to climb 5.5 per cent to nearly $1.3 million.

Sources:

The post Vancouver Real Estate Sales Continue to Soar Amid Shrinking Supply appeared first on RE/MAX Canada.