The Calgary real estate market has seen its condominium sector rising considerably in recent months, with apartment sales up almost 65 per cent year-over-year. Close to 4,600 condominium sales were reported between January and August of this year, up from 2,778 during the same period in 2021. Average price has followed in lockstep, with year-to-date condominium apartment values climbing six per cent to $279,306 in 2022, up from $263,502 one year prior.

Rising interest rates and affordability have contributed to the popularity of the condominium lifestyle in recent years. Almost one in every five properties sold in the Calgary real estate market is a condominium. With each Bank of Canada announcement on hikes to the overnight rate, entry-level buyers re-evaluated and re-adjusted to new market realities. Rapid escalation of rental rates also prompted would-be renters to pursue home ownership, with the monthly rate for a one-bedroom apartment in Calgary rising to $1,597 (+29.8 per cent year-over-year) and a two-bedroom apartment now sitting at $1,891 (+19.7 per cent year-over-year).

Condominiums in suburban locations are most popular with today’s buyers. Areas such as Saddle Ridge, Panorama Hills, Currie Barracks and McKenzie Town have experienced strong demand over the past eight months, with sales figures for condominium apartments doubling year-over-year. Values are climbing as well, with double-digit increases posted in Saddle Ridge, Panorama Hills, Currie Barracks, Garrison Woods and Killarney/Glengary. However, demand for condominium apartments in the city’s downtown core remains lukewarm as people continue to work from home. That could change in the months ahead as more people return to jobs in the downtown core.

Buyers from out of province – typically British Columbia and Ontario – continue to pour into Calgary and invest in the city’s housing stock. Inventory levels across all property types in the Calgary real estate market are down from year-ago levels, setting the stage for another heated housing market come January. Alberta is likely to lead the country in economic performance this year, with GDP expected to reach 4.9 per cent in 2022. Economic fundamentals continue to improve in the province overall, consumer confidence is on the upswing and housing markets in both Calgary and Edmonton reflect the provincial return to growth and prosperity.

Condominium Trends in the Canadian Real Estate Market

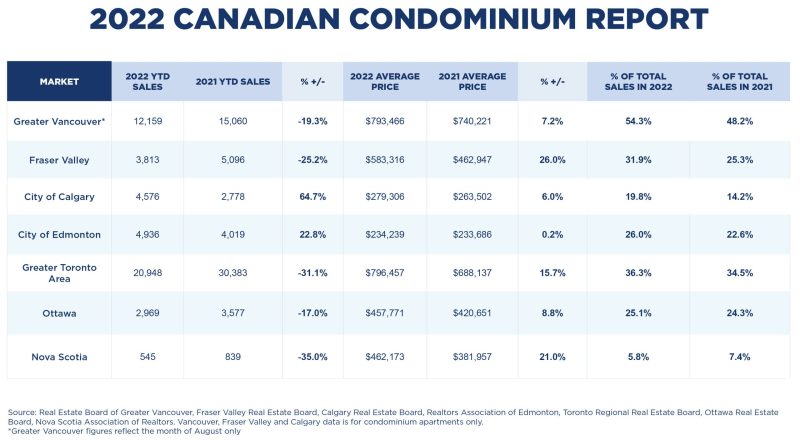

Condominium market share has grown in major urban Canadian real estate markets yet again this year, a reflection of new market realities and the shifting course of entry-level buyers. RE/MAX Canada’s 2022 Canadian Condominium Report examined more than 120 communities in six major markets, including Greater Vancouver/Fraser Valley, Calgary, Edmonton, Greater Toronto, Ottawa and Nova Scotia. The report found that condominium sales were down in the first eight months of 2022 in four markets, including Greater Vancouver/Fraser Valley, Greater Toronto, Ottawa and Nova Scotia, while Calgary and Edmonton reported double-digit sales increases over the same period in 2021. Condo values are up in almost all markets year-over-year, with many bolstered by a robust strong first quarter.

Condominium market share, as a proportion of total Canadian real estate sales, advanced across the board, with upswings reported in five out of six markets analyzed, ranging from a low of 0.08 per cent in Ottawa to a high of 6.6 per cent in the Fraser Valley. Compared to year-to-date levels one year ago, condominiums now represent just over 54 per cent of total residential sales in Greater Vancouver, 36.3 per cent of residential sales in the Greater Toronto Area, almost 32 per cent of sales in the Fraser Valley, just over one in four sales in Edmonton and Ottawa, and almost one in five sales in Calgary. Nova Scotia was the only market to register a decline in condominium market share.

“The affordability factor is the key issue in today’s housing market,” says Christopher Alexander, President, RE/MAX Canada. “Rising interest rates have slowly eroded purchasing power and, despite lower housing values and cooling market conditions, buying a house is more challenging now than ever before. For those who have adjusted expectations with every rate hike, the cost of carrying a mortgage versus renting is now more comparable, given sharp double-digit increases in rental rates throughout the major markets, but especially in BC and Ontario. So, while fewer sales have occurred in 2022, condominiums represented a greater proportion of overall sales, as buyers gravitated to affordable options to achieve home ownership.”

The post Calgary Real Estate: Condo Sales Rise 65% in 2022, Price Up 6% appeared first on RE/MAX Canada.